.png)

.jpg)

Credit analysts often face the daunting task of sifting through earnings call transcripts, financial filings, and investor reports to assess an issuer’s creditworthiness. Captide – an AI-powered research platform – streamlines this process by allowing analysts to pose natural language queries across multiple documents and instantly extract key insights. In this blog, we demonstrate how to use Captide for a fixed income credit risk review, using Rolls-Royce Holdings plc as a real-world example. The result is a comprehensive analysis of Rolls-Royce’s credit profile, generated swiftly by Captide’s document analysis capabilities. While our focus in this article is on credit risk, the approach and Captide’s functionalities are equally applicable to equity research, investment banking due diligence, and hedge fund investment analysis.

Captide is built for precision document analysis in finance, combining AI with explainable outputs. Key features that empower credit analysts include:

Captide’s focus on corporate disclosures makes it a powerful assistant for fundamental analysis. Equity analysts can dig into growth and operational metrics, while credit analysts can zero in on debt covenants or liquidity details. The following sections illustrate a step-by-step use case: performing a detailed credit risk review of Rolls-Royce using Captide’s toolkit.

Step 1: Gathering Key Financial Highlights – We begin by asking Captide to summarize Rolls-Royce’s latest financial and credit highlights. A query like “Summarize Rolls-Royce’s current credit ratings, outlooks, and recent financial performance” yields a concise overview. Captide quickly identifies that, as of mid-2025, all three major rating agencies upgraded Rolls-Royce to investment grade with positive outlooks. In fact, Fitch raised the rating to ‘BBB+’ (from ‘BBB-’) with a Positive Outlook in June 2025, citing Rolls-Royce’s significantly improved financial profile – 2024 EBITDA margins of ~16% and a net cash position by year-end. Moody’s and S&P followed suit (Moody’s at Baa2 Positive, S&P at BBB Positive), reflecting growing confidence in the company’s turnaround.

Captide also surfaces the dramatic shift in Rolls-Royce’s balance sheet. By scanning the 2024 annual results and earnings calls, it notes that Rolls-Royce moved from a net debt of £3.25 billion in 2022 to a net cash position of £475 million at end-2024, thanks to strong free cash flow and debt reduction measures. The company’s total liquidity was about £8.1 billion (including £5.6 billion cash on hand and a £2.5 billion undrawn credit facility). These figures are pulled directly from the company’s filings and a Fitch report, ensuring accuracy. We learn that 2024 free cash flow reached £2.4 billion, nearly doubling from the prior year, and that liquidity was bolstered by the repayment of a €550 million bond and the cancellation of an unused loan facility.

.jpg)

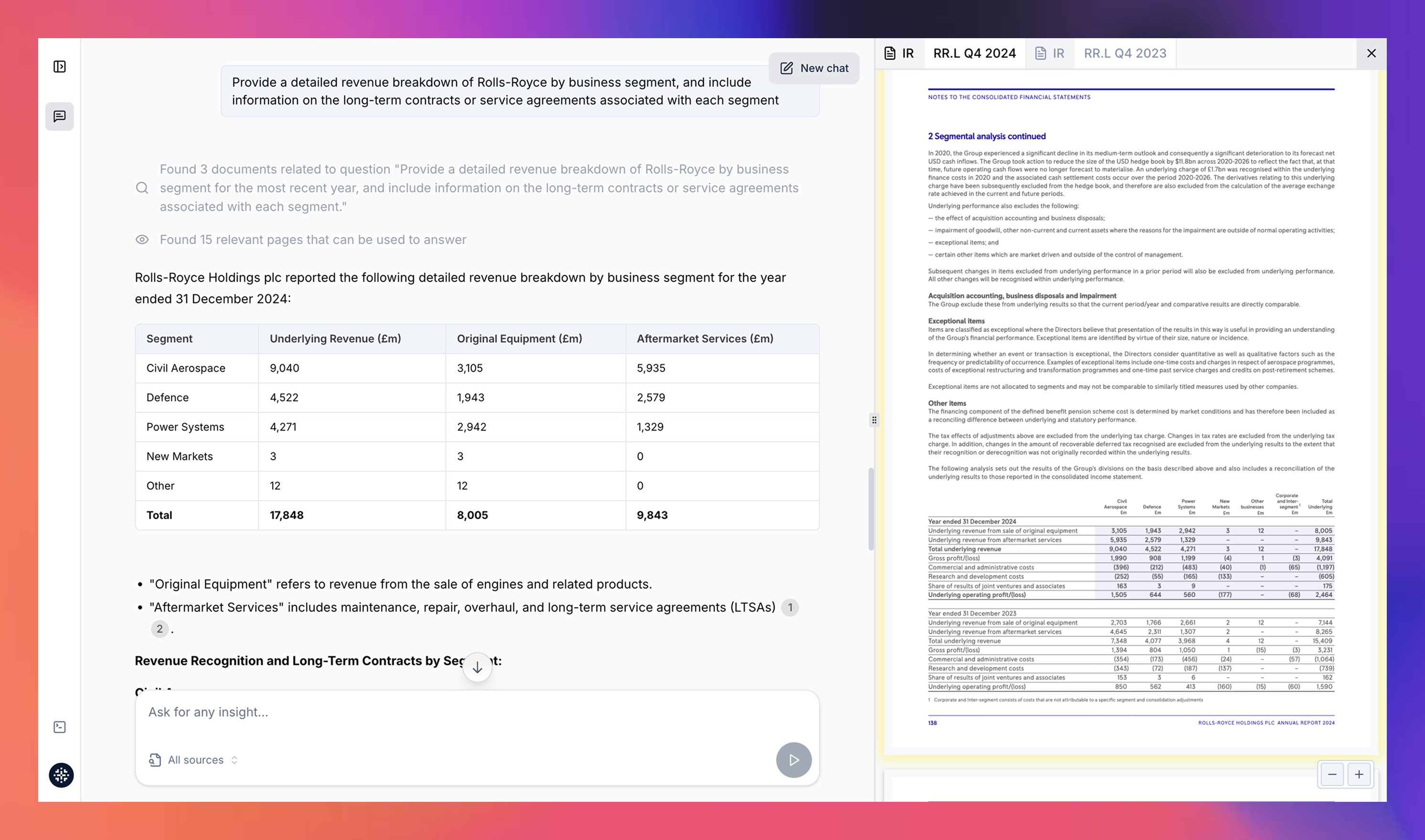

Step 2: Extracting Business Segment Insights – A thorough credit review goes beyond headline numbers. Using Captide, we query the platform for details on Rolls-Royce’s business model and revenue breakdown to understand its operating context. Captide scours the 2024 annual report and presents a structured overview of the company’s four main segments: Civil Aerospace, Defence, Power Systems, and New Markets. It notes that Rolls-Royce generates substantial recurring revenue from long-term service agreements (especially in Aerospace and Defence), which is a positive for cash flow stability. For 2024, Captide finds that underlying revenue was £17.8 billion with an operating margin of 13.8%, and highlights management’s focus on aftermarket services and a multi-year transformation program to boost efficiency.

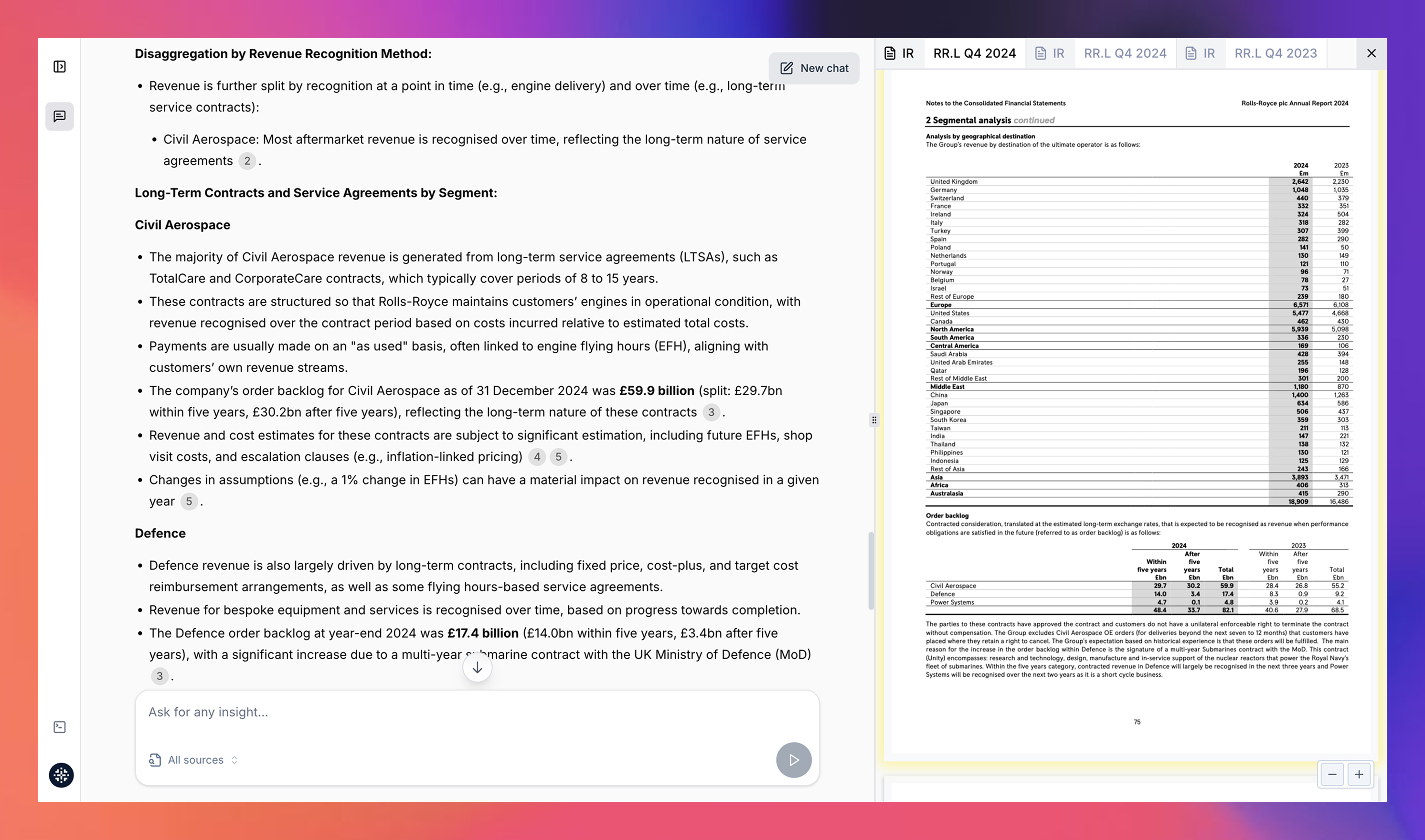

We also ask Captide to retrieve revenue by geography for FY2024 – a query that prompts it to extract the regional breakdown from the annual report. The platform produces a table showing that total revenue was £18.9 billion in 2024, with over 65% coming from Europe and North America combined. The UK and US alone contributed £8.1 billion (about 43% of total) as the two largest markets. Asia accounted for roughly £3.9 billion (driven by China and Japan), and the Middle East ~£1.2 billion, among other regions. This diversified revenue base, summarized in a Captide-generated table, helps analysts gauge the geographic spread of Rolls-Royce’s business – relevant for assessing exposure to regional economic trends or geopolitical risks.

Step 3: Analyzing Operating Performance and Drivers – Next, we delve into operating trends using Captide’s ability to parse earnings call transcripts and investor presentations. For instance, to evaluate Rolls-Royce’s post-pandemic recovery, we ask: “What did management say about Civil Aerospace demand in recent calls?” Captide extracts a key line from the Q1 2025 trading update: large engine flying hours in Civil Aerospace reached 110% of 2019 levels in the first quarter of 2025, indicating that airline activity (and thus aftermarket revenue) has not only recovered but surpassed pre-COVID levels. This is a strong signal of revenue momentum in the most important segment. The platform also finds that underlying aftermarket revenues were strong due to higher shop visit volumes, reflecting robust demand for engine maintenance – a high-margin business for Rolls-Royce.

Using a similar approach, we query for recent operational improvements. Captide surfaces information that operating margins have dramatically improved across divisions. Civil Aerospace margin climbed from just 2.5% in 2022 to 16.6% in 2024 as the company benefited from cost-cutting and higher volumes. Defence margins reached 14.2% in 2024 (up from 11.8% two years prior), and Power Systems margins also rose to 13.1% in 2024. These points were gathered from investor day presentations and earnings discussions, demonstrating how Captide can aggregate multi-year performance data for each segment. We also learned of recent business wins – e.g. new engine orders from airlines like VietJet and IndiGo – which Captide pulled from press releases, emphasizing growth opportunities that further support credit quality.

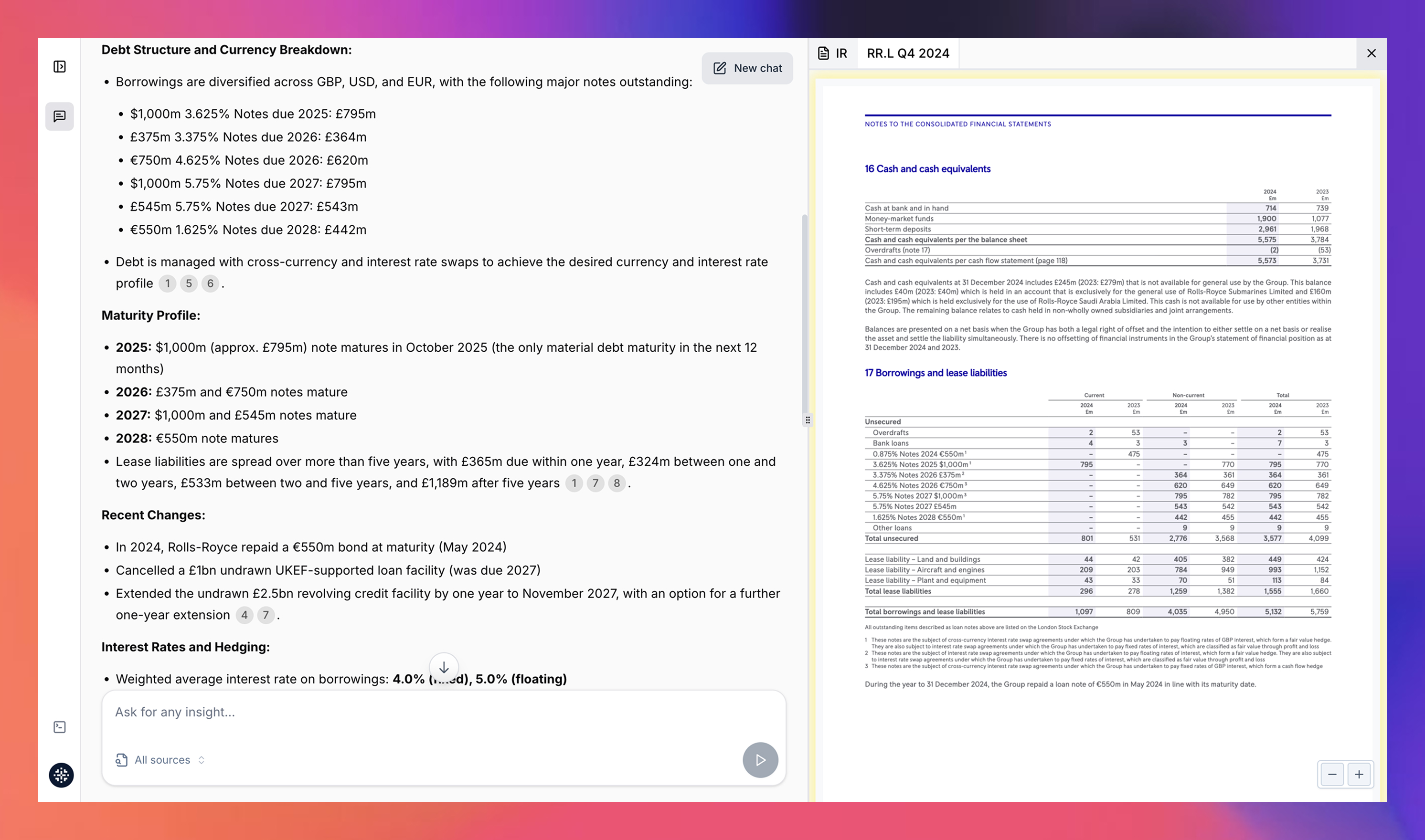

Step 4: Credit Profile and Debt Analysis – A core part of credit risk review is examining the capital structure. Captide can extract details on debt levels, maturities, and coverage ratios from financial statements and notes. By asking “Summarize Rolls-Royce’s debt profile and interest coverage”, we received an overview of the company’s deleveraging efforts: Rolls-Royce’s interest coverage ratio improved from 1.9× in 2022 to 8.3× in 2024, as operating profits surged and interest costs fell. Captide also noted that by end-2024, Rolls-Royce’s cash on balance sheet (£5.6 billion) exceeded its total debt, yielding a cash-to-debt ratio above 1.0×. In practical terms, the company has more than enough cash to cover all borrowings – a remarkable turnaround from prior years and a strong credit positive.

Captide further helped outline the debt maturity schedule. The next major bond maturity is a $1 billion note due in October 2025, which the company appears well-positioned to handle (management has indicated it can be repaid from available cash). Beyond that, debt maturities are staggered into 2026–2027, reducing near-term refinancing risk. Importantly, Captide’s extraction from the annual report confirmed that none of Rolls-Royce’s borrowing facilities carry financial covenants or rating-based triggers that could accelerate repayment. This means a downgrade or other event would not automatically strain liquidity – a useful insight Captide pulled from the debt footnotes. Additionally, we found that the company’s £2.5 billion revolving credit facility was recently extended to 2027, giving extra cushion. All these details illustrate how Captide equips analysts to evaluate solvency and liquidity: by collating data on cash flow (e.g. free cash flow of £2.43 billion in 2024), debt outstanding, and contractual terms, one can quickly assess if the issuer is at risk of distress (in Rolls-Royce’s case, the signs are broadly positive).

To double-check qualitative aspects, we asked Captide for any going-concern or audit flags in the filings. The platform reported that auditors did not highlight any material uncertainties about Rolls-Royce’s ability to continue as a going concern, reinforcing confidence in its financial stability. All these findings feed into our credit assessment, essentially forming an automated credit memo on the company.

Step 5: Extracting Management Outlook and Guidance – With historical and current data in hand, Captide also helps capture forward-looking indicators. For example, by querying “What is Rolls-Royce’s guidance for 2025 free cash flow and profit?”, we obtained management’s latest outlook from the Q1 2025 trading update. Rolls-Royce maintained guidance for FY2025 free cash flow of £2.7–£2.9 billion and a similar £2.7–£2.9 billion range for underlying operating profit. Captide provided the exact figures along with the source context that this guidance was reiterated as the company had a strong start to 2025. This insight is critical for credit analysts: projected cash flow in the £2.8 billion range, if achieved, means further deleveraging or shareholder returns are possible. In fact, the Fitch report that Captide indexed expects Rolls-Royce’s EBITDA margin to rise above 17% in 2025 and anticipates continued strong cash generation. Thus, Captide not only gathers what has happened but also what management and third parties expect to happen, which aids in forming a forward-looking credit view.

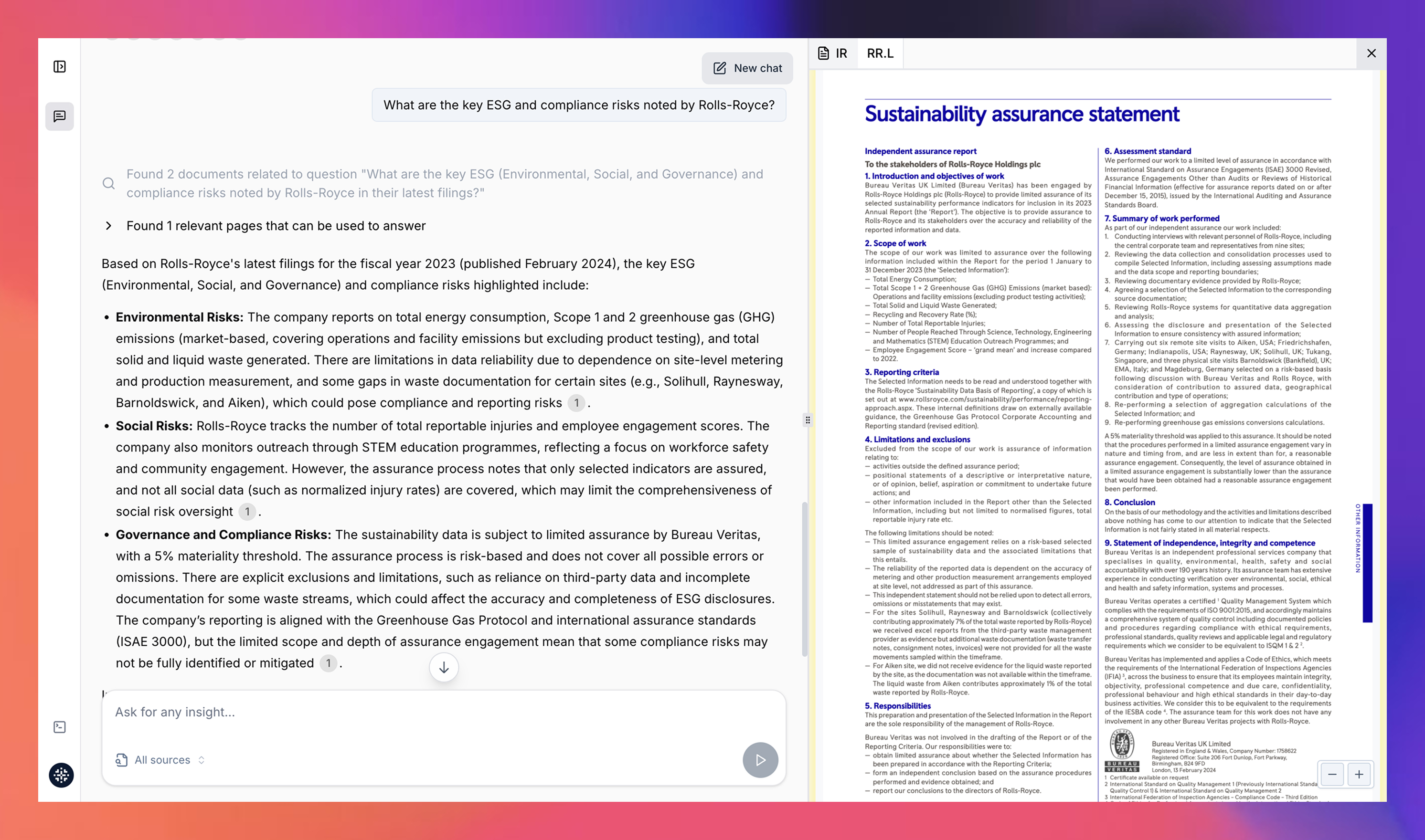

Step 6: ESG and Risk Factor Analysis – Modern credit analysis also considers environmental, social, and governance (ESG) risks, as well as regulatory or legal matters. Captide’s ability to parse qualitative sections of reports (like annual report risk factors or sustainability reports) is very handy here. By asking something like “What are the key ESG and compliance risks noted by Rolls-Royce?”, we quickly learned from the 2024 filings that Rolls-Royce identifies climate transition as a principal long-term risk. In fact, the company discloses eight principal climate-related risks and conducts scenario analyses to test its resilience. Captide pulled out details such as Rolls-Royce’s commitments to net zero operations by 2030 and net zero emissions across its value chain by 2050, which were mentioned in the sustainability narrative. Notably, 74% of its 2022 R&D spending was aligned to net-zero technologies, underscoring a strategic pivot toward low-carbon solutions (e.g., developing sustainable aviation fuel compatibility and small modular nuclear reactors). These data points, sourced from Rolls-Royce’s climate review, show how Captide can surface non-financial metrics that influence credit—credit rating agencies increasingly reward companies preparing for carbon transition.

On the governance and regulatory front, Captide helped summarize Rolls-Royce’s compliance posture. The platform found references to the company having completed its Deferred Prosecution Agreement (DPA) obligations related to past bribery cases, although some authorities continue oversight. Rolls-Royce has reinforced its compliance framework with measures like mandatory ethics training, internal audits, and a “three lines of defence” risk management model. Such information, which Captide extracted from the company’s proxy statement and annual report, is crucial for credit analysts: major compliance lapses could bar Rolls-Royce from lucrative defense contracts or export markets, indirectly affecting its credit health. By using Captide to pull these disclosures, an analyst ensures that qualitative risk factors (like legal, regulatory, or ESG issues) are not overlooked in the credit review. This showcases Captide’s utility beyond numbers – it can digest narrative sections and flag potential red or green flags for further investigation.

A single company’s metrics are better understood in context – hence, we often compare an issuer against its industry peers. Captide’s multi-document capability is extremely useful for conducting a relative credit analysis. In our case study, we ask Captide to compile key financial and credit metrics for Safran SA (a French aerospace peer) and GE Aerospace (the aviation arm of General Electric) alongside Rolls-Royce. By querying across these companies’ filings and press releases, Captide delivered a side-by-side comparison that we could easily turn into a table:

By leveraging Captide for this peer analysis, we could quickly identify where Rolls-Royce stands out and where it lags. The automation of data extraction meant we spent more time interpreting the implications (e.g., Rolls-Royce’s improving credit spreads might tighten further if it keeps closing the gap with Safran/GE on metrics) and less time trawling through dozens of pages of reports. This exemplifies Captide’s value: rapid, reliable collation of facts for deeper comparative insight.

After compiling the above information, an analyst can use Captide’s output to form an investment recommendation. In our Rolls-Royce case study, the data points to a company that has made a strong credit comeback. Let’s recap the key findings Captide helped uncover, and how they translate into a strategic view:

Given these points, an analyst could confidently conclude – as we do – that Rolls-Royce is well positioned to sustain its investment-grade credit quality over the medium term. In portfolio terms, the case study we conducted with Captide would lead us to recommend a moderate overweight in Rolls-Royce bonds. The rationale: the company’s credit spreads may not yet fully reflect the improved fundamentals and positive trajectory. Bonds maturing in the 2026–2027 range, for example, offer a chance to benefit from further spread tightening as Rolls-Royce continues to deleverage and execute on its transformation plan.

It’s important to note that this recommendation balances opportunity with remaining risks – Captide helped us identify that macro factors and aviation cyclicality are external risks to monitor. A global downturn or a shock to air travel could slow Rolls-Royce’s progress. However, with no glaring internal weaknesses (liquidity, operational issues, or governance problems have been largely addressed), the risk/reward profile is attractive for investors seeking exposure to industrial credits on an improving path.

Performing a deep credit analysis no longer needs to be a labor-intensive process of digging through documents. As we demonstrated with the Rolls-Royce credit review, Captide empowers analysts to efficiently gather data and insights: from headline financial improvements to granular risk factors. The platform’s natural language querying and multi-document coverage allowed us to create a comprehensive credit report that highlighted Rolls-Royce’s surging free cash flows, improved leverage and liquidity, robust competitive position, and even its ESG initiatives – all with sources linked for verification. This not only increases the thoroughness of the analysis but also the confidence in its accuracy.

For institutional investors and credit analysts, using Captide in day-to-day research can mean quicker turnaround on credit memos, the ability to continuously monitor issuers (by querying the latest filings for changes), and more time to devote to strategy rather than data extraction. Our Rolls-Royce case study is just one example of Captide’s capabilities. Whether one is comparing peer companies across continents or drilling into a single issuer’s covenant details, the platform acts as a powerful co-pilot in the analysis process.